south dakota sales tax rate changes 2021

In addition the town of Henry is amending their municipal tax rate from 1 to 2. July 1 2021 Sales Tax Rate Changes.

Sales Use Tax South Dakota Department Of Revenue

All rates are General Retail Sales or Use tax rates and do not reflect special category product.

. July is always a busy month for sales and use tax rate changes in the US. The Richland sales tax rate is. October 2021 140 changes Over the past year there have been 1039 local sales tax rate changes in states cities and counties across the United States.

Look up 2022 sales tax rates for Chance South Dakota and surrounding areas. The maximum local tax rate allowed by. Tax Rate Starting Price Price Increment South Dakota Sales Tax Table at 10 - Prices from 117100 to 121780 Print This Table Next Table starting at 121780 Price Tax 117100 010 120 012.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Stacey Anderson Marketing Communications Specialist 605-773-5869 PIERRE SD. Legislative Updates New Municipal Tax Changes Effective January 1 2022 12-01-2021 1 minute read Beginning January 1 2022 the town of Lane is implementing a new municipal tax rate from 0 percent general sales and use tax rate to 2 percent.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. Look up 2021 sales tax rates for Jones County South Dakota. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1817 for a total of 6317 when combined with the state sales tax.

South Dakota SD Sales Tax Rate Changes The following are recent sales tax rate changes in South Dakota. The South Dakota Department of Revenue administers these taxes. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6 South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. This page will be updated. What Rates may Municipalities Impose.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Municipalities may impose a general municipal sales tax rate of up to 2. The municipal tax changes taking effect include.

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. Tuesday June 1 2021 Contact. 366 rows 45 Average Sales Tax With Local.

Find your South Dakota combined state and local tax rate. Click here for a larger sales tax map or here for a sales tax table. SOUTH DAKOTA LOCAL.

This page allows you to browse all recent tax rate changes and is updated monthly as new sales tax rates are released. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. There are a total of 290 local tax jurisdictions across the state collecting an average local tax of 1817. New rates were last updated on 712021.

By Teresa Farnsworth June 25 2021. Tax rates are provided by Avalara and updated monthly. As of January 1 2021.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The base state sales tax rate in South Dakota is 45. Raised from 55 to 65 Gary.

The South Dakota sales tax and use tax rates are 45. For Immediate Release. US Sales Tax Rates Sales Tax.

South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales. Beginning July 1 2021 four South Dakota communities will implement a new municipal tax rate. 6317 South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6.

Old rates were last updated on 712020. The state sales tax rate in South Dakota is 45 but you can customize this table as needed to reflect your applicable local sales tax rate. Over the past year there have been ten local sales tax rate changes in South Dakota.

Tax rates provided by Avalara are updated monthly. City january 2021 rate general code january 2021 rate tax code lodging eating establishments alcohol admissions aberdeen 200 001-2 100 1 x akaska 200 004-2 alcester 200 006-2 alexandria 200 007-2 alpena 100 009-2 andover 200 011-2 arlington 200 013-2 armour 200 014-2 artesian 200 015-2 ashton 200 016-2.

State Corporate Income Tax Rates And Brackets Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Sales Use Tax South Dakota Department Of Revenue

State Corporate Income Tax Rates And Brackets Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

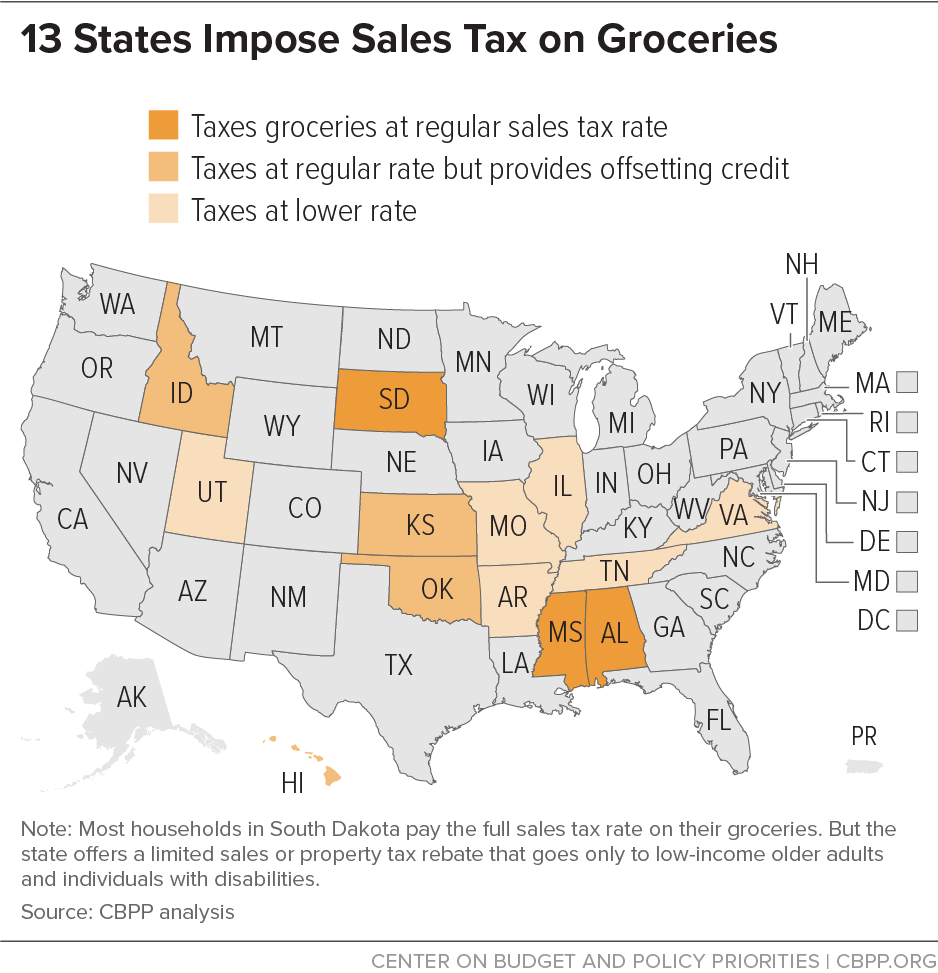

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Mapped The Growth In U S House Prices By State

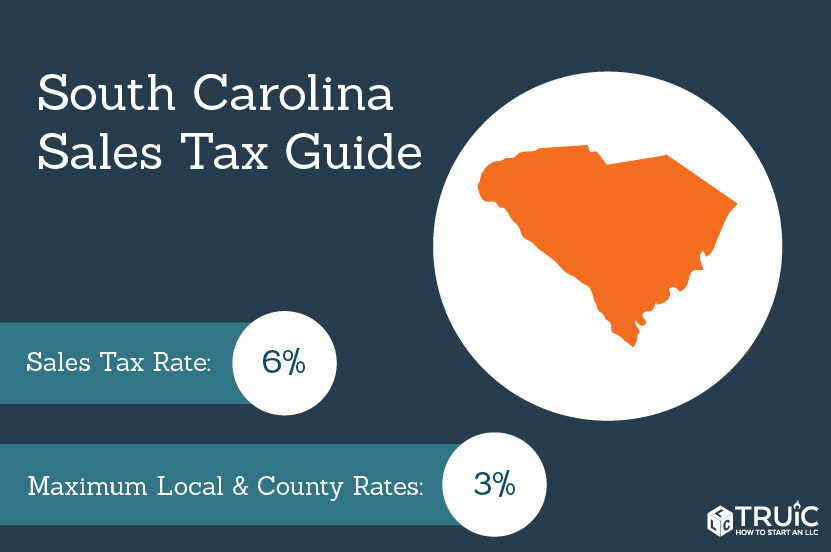

South Carolina Sales Tax Small Business Guide Truic

Sales Use Tax South Dakota Department Of Revenue

.png)

States Sales Taxes On Software Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States Without Sales Tax Article

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)